Many Americans 65 and older depend on Medicare for healthcare benefits. Reaching Medicare age is a milestone many look forward to because it signifies the start of their retirement years. However, Medicare plans are more complex than ever, so it is in your best interest to understand your policy needs. To this end, our health insurance agents at Buffalo Health Advisors are here to help you choose the right plan for your situation.

Not all medical costs are covered by traditional Medicare plans. Therefore, many people choose to supplement their coverage with private insurance or a Medicare Advantage plan.

Start exploring Medicare quotes with our handy comparison tool. Or keep reading to learn more about the types of Medicare Advantage plans we can help you join for no added cost.

Individual Short-Term Health Insurance

Individual Dental Insurance

This is a solicitation for insurance

What Is Medicare Advantage?

Also known as Medicare Part C or MA Plans, Medicare Advantage provides Part A & B Medicare coverage through a managed care model. Additionally, Advantage packages often include extra benefits not covered by traditional Medicare. Hence why many individuals add a Medicare Advantage plan to their medical insurance portfolio.

People also ask what the difference is between Medicare Advantage and Original Medicare. Parts A and B (Original Medicare), are in part paid for and provided by Social Security. In contrast, Advantage plans are offered by private insurance companies for you to purchase.

Legally speaking, Advantage plans must offer the same amount of coverage as Original Medicare. However, these plans are usually a combination of Medicare Part A, Part B, and sometimes Part D for prescription drug coverage. Some plans also come bundled with vision, dental, and hearing benefits.

How Do Medicare Advantage Plans Work?

Even though these plans are offered by private insurance companies, Medicare pays those companies a fixed amount every month to pay for your coverage. Every year, these companies make contracts with Medicare that spells out how much the government program will pay for. This is why your Medicare coverage can change from year to year.

If any changes are made to your coverage plan, you will be notified. Still, it can be frustrating trying to keep up with changes in your coverage. If you have any questions or concerns about your coverage, call Buffalo Health Advisors. We make Medicare simple.

Medicare Advantage Requirements

In order to qualify for Medicare Advantage coverage, you must be 65 years of age or older and qualify for Medicare Part A and Part B. There are exceptions to this. For example, people under 65 with a qualifying disability may qualify for Medicare Advantage.

As with other types of health insurance, you must apply for coverage during the open enrollment period, when you turn 65, or after another qualifying event.

Medicare Advantage Plan Options

Plan availability varies depending on what private insurance companies offer in your area. However, the different types of Medicare Advantage plans include:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private Fee-for-Service (PFFS)

- Special Needs Plan (SNP)

How Do I Choose the Right Medicare Plan?

With so many MA plan options, it can be hard to know which plan to choose. We can help you compare Medicare Advantage plans when you’re shopping for health insurance benefits. The first thing we go over is your needs and expectations such as:

- Do you like your current PCP?

- Do you have upcoming health needs? (surgery, check-ups, increased risk factors, etc.)

- What did you like about your previous coverage?

- Would you prefer prescription drug coverage?

- What are your desired benefits?

- Do you need to see a specialist regularly?

The more you know about what you need, the easier choosing a Medicare plan will be. Give us a call and we’ll help you compare insurance plans.

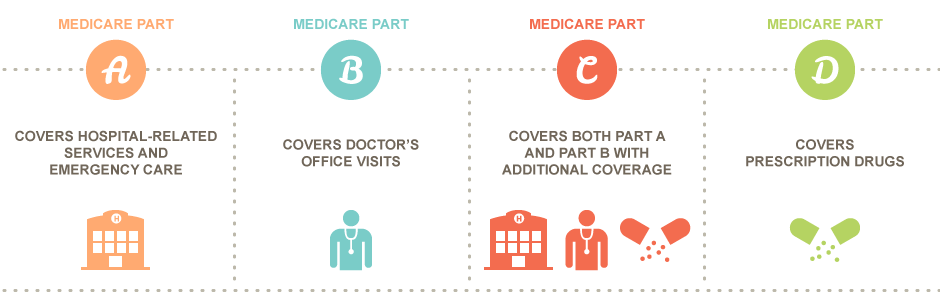

Medicare Parts Overview

Let Us Help You Find The Right Medicare Plans

At Buffalo Health Advisors, we believe in providing solutions to individuals as they transition to Medicare plans. We do this because we know that, choosing the right Medicare Advantage plan can work to protect your health as well as help you maintain your wealth. In fact, the decision to join a Medicare Advantage plan is critical if you are living on a fixed income during your retirement.

How To Sign Up For Medicare Advantage Plans

Be Aware of Enrollment Periods

First, in order to join an Advantage plan, you must sign up during either your initial enrollment period or during the yearly general enrollment period. If you’re just aging into Medicare, you can apply three months before your 65th birthday, during your birth month, and the three months after your birthday.

Consequently, if you miss the initial enrollment period, you will have to sign up during the general enrollment period. Usually, people who sign up during this period will have to pay late enrollment fees. However, if you qualify for a special enrollment period, you can sign up for Medicare at any time. Additionally, special enrollment allows you to avoid paying late enrollment fees.

Requirements for a special enrollment period include certain life events, disability, change of employment, or loss of employer-related health care coverage.

General Enrollment Period for Medicare

If you missed the initial enrollment period for Medicare you can also sign up during the General Enrollment Period (GEP).

The GEP opens every year on January 1 and closes on March 31. During this period you can sign up for Medicare Part B. However, you might have to pay a penalty for late enrollment.

Purchasing a plan during the GEP means your coverage will start on July 1. But until then, you will not have Medicare coverage.

What If I Already Have Medicare?

Second, you may automatically qualify for Medicare. If that’s the case, you’ll automatically start getting benefits.

However, if Original Medicare does not cover everything you need, you can still enroll in an Advantage plan. Especially if you need a plan that includes prescription drug coverage. You can also switch to a different plan later on if your needs change.

But How Do I Sign Up?

Finally, actually signing up for a plan usually involves applying via the plan’s website, through a paper form, calling the insurance company directly, or working with an insurance broker.

As a side note, if you want to switch your coverage, you will also have to pay attention to enrollment times. You should also note that if you plan to drop previous coverage for an Advantage plan, you won’t be able to swap back later.

Why Work With Buffalo Health Advisors?

In our experience as health insurance advisors, we’ve seen many people struggle to get the benefits they need when they try to do it alone. Insurance companies and even insurance brokers are pushing for that sale, so you can feel pressured to buy a plan you don’t need.

Our health advisors work on your behalf to get you the plan you need. We don’t take commissions and we help you find a plan at no cost to you. That way, you never feel pressured to accept a plan you don’t need.

Plus, from our years of experience, we know how to ask the right questions that will get you the right plan.

Get to Know Our Advisors

We have also featured some of our health insurance agents in educational videos, so you can get to know them before your appointment. You can see more of our work on the Buffalo Health Advisors Official YouTube channel.

Call Buffalo Health Advisors Today!

Learning more about your available health plan options will cost you nothing when you call Buffalo Health Advisors. If you prefer to meet face to face, you can stop by our Nashville, TN office, or one of our other offices in Middle Tennessee.

Find someone to talk to about your health insurance today at Buffalo Health Advisors.

When you think Medicare, think Buffalo.

Hallie Mitchell

Operations

Director

Tiffany Porter

Growth Director

Debbie Carter

Commissions Director

Harrison Cheatham

Account Manager

KY, TN

Junior Douglas

Account Manager

TN, AL

Mark Borders

Account Manager

TN

Gabbi Green

Contracting Lead

Kendall Chanley

Recruiting Lead

Rachel Fuerst

Operations

Rachel Crooks

Project Manager