Medicare Supplements, such as Medigap, can help bridge the gap of what’s covered by your plan. For example, original Medicare usually covered 80 percent of the cost of medical services, leaving beneficiaries to pay 20 percent of their health care costs out of pocket.

This is a solicitation for insurance

How do I know if I need Medigap Coverage?

Since Original Medicare Plans leave that 20 percent for you to cover, your medical needs will determine whether or not you need Medigap. If you have a higher risk for heart attacks, pneumonia, surgery, or medical condition that requires expensive treatment, you may want a Medicare Supplement Plan. Of course, if you have one of these risk factors, it may be harder to buy a plan from an insurance company.

Will Medigap Work with other Advantage Plans?

While it is still possible to be enrolled in Medigap and a Medical Medicare Savings Account (MSA), you will not receive Medigap coverage while enrolled in an advantage plan.

But, at the very least, a Medicare supplement plan will help pay a portion of the 20 percent not covered by Part A or Part B.

What Is the Difference Between Medicare Supplement and Medicare Advantage Plans?

Just to clarify the difference between these plans, Medigap is supplemental coverage you can add to Original Medicare Parts A and B. In contrast, Medicare Advantage plans are a private insurance alternative to Original Medicare.

In terms of price, Medigap plans typically have higher premiums than MA plans. But, they will help you reduce out of pocket costs when receiving care. Availability and choice of physicians is another consideration for potential Medigap buyers. Not every plan will be accepted by your current physician or specialist, so be sure to carefully review which plans are accepted in your area.

What are the other benefits of Medigap Plans?

A supplement plan can apply to certain holes in your Medicare coverage, especially important ones. If you need extended hospital care, a Medigap plan can help you get the care you need.

Nursing and Hospice Care

Certain Medigap plans may be able to help cover nursing home care. However, this does not cover long-term assisted living, personal care, or Alzheimer’s care. They can provide temporary nursing home care coverage payments, but once again not in the long term. Supplemental plans can also provide assistance with hospice coverage.

Travel Insurance

If you plan on frequently traveling out of the United States during your retirement, look for a Medigap plan that covers travel insurance. Usually, Original Medicare does not cover or provides limited coverage outside of the United States.

If you buy a Medigap plan, it can specifically cover foreign travel emergencies and help pay for medical emergencies. The stipulation of payment for travel emergencies is that the plan will only pay if it occurs in the first 60 days of your trip. For medically necessary emergencies, your plan will pay for 80 percent of billed charges, but only after you meet a $250 yearly deductible.

Renewal

One of the best benefits of Medigap policies is renewal. If you buy a standardized Medigap insurance plan, it is guaranteed that you can renew it as long as you pay the premium. This means that the insurance company cannot cancel your policy. You decide how long you keep your policy.

How do I sign up for a Medicare Supplement Plan?

Medicare supplement insurance plans, or Medigap policies, are sold by insurance companies licensed to sell them. A private insurance company that sells Medigap coverage can usually use medical underwriting to decide if they will accept your application.

If you’re looking at Medicare supplements, know that the best time to buy one is during open enrollment periods. Because beneficiaries age into Medicare, open enrollment starts the first month after you turn 65.

The open enrollment period lasts for six months. Outside of that time period, you may be able to buy a policy, but there is no guarantee. Usually, any plans available after the open enrollment will cost more.

Also, you should not worry if you get sick during your open enrollment period. Insurance companies will usually sell you a plan for the same price as if you were still healthy.

Why Should I Buy a Medigap Policy?

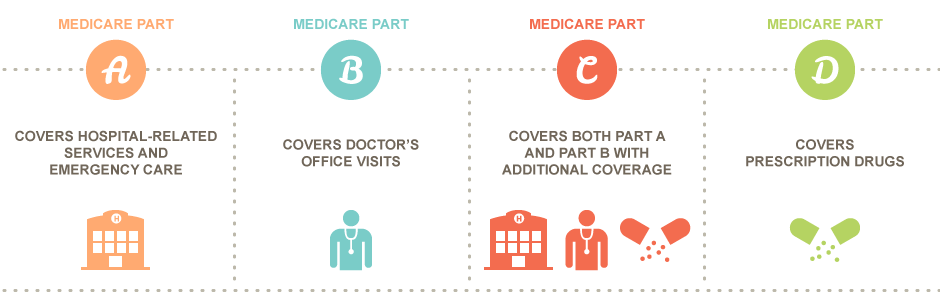

Before you buy a Medigap plan, you must have both Medicare Part A and Part B. Medigap plans only cover one person, so spouses must purchase separate plans. Once purchased, you pay the insurance company a monthly premium as well as the monthly Medicare Part B premium.

It’s important to know that you usually cannot sign up for a Medicare Advantage Plan and a Medigap plan at the same time.

What if I need Prescription Drug Coverage?

You may wonder about getting a Medigap prescription drug plan, unfortunately, they are no longer available. Medicare supplements sold before 2006 sometimes covered prescription drugs. Since 2006 though, Medigap policies do not cover prescription drugs.

If you need coverage for your prescriptions, you can sign up for a Part D Medicare prescription drug plan. Be aware that you will need to pay a premium for Part D coverage.

What if I need help Comparing Medicare Supplements?

With plenty of plans to choose from, it’s hard to always know what’s best for you, especially since plans change every year! That’s where we come in.

At Buffalo Health Advisors you can find someone to talk to about all your options. Our professional health insurance agents will help you compare Medicare plans and Medigap plans at no cost to you.

We know that Medicare and Medigap can be confusing, and that’s why we’re here. When you step into our office we take time to get to know you and your needs. We help you understand your options and compare plans before you decide. We want to make sure you get the coverage that works right for you.

Why Buffalo Health Advisors

When we work with people, they often worry that insurance companies don’t have the plan that they need. The reality is that these private companies have many options, but it comes down to whether or not you’re asking the right questions. From our many years of combined experience, we know how to ask those questions and get you what you need.

Another thing that sets us apart is that we work independently from insurance companies to help you get the insurance you need. Therefore, we will never try to sell you a plan that does not get you what you want.

Learn more about the benefits of medicare supplements here. If you need any other information about health insurance or Medicare coverage, don’t hesitate to ask! Set up an appointment with one of our health insurance agents or give us a call today and we’ll help you find the right plan for you.

Hallie Mitchell

Operations

Director

Tiffany Porter

Growth Director

Debbie Carter

Commissions Director

Harrison Cheatham

Account Manager

KY, TN

Junior Douglas

Account Manager

TN, AL

Mark Borders

Account Manager

TN

Gabbi Green

Contracting Lead

Kendall Chanley

Recruiting Lead

Rachel Fuerst

Operations

Rachel Crooks

Project Manager